Giving It All Away: My Philanthropic Plan

This is a different kind of piece from what I normally publish. It’s about philanthropy, not technology or management, and it’s fairly personal (“here’s what I did”) rather than giving advice (“here’s what you should do”).

As such, it’s not intended for a general audience. I’m guessing most of my readers will want to skip this one. I mean, read it if you want, I’m not your dad.

My intended audience here is someone in a similar place to where I was last year: someone who wants to donate the majority of their wealth within their lifetime, and wants a charitable giving plan – something more holistic and long-term than ad hoc individual gifts.

Summary

This is a long ‘un, so here’s the short version:

- Last year, my wife and I built a philanthropic plan: a strategy to guide our charitable giving for the rest of our lives, with the goal of giving away almost all of our wealth in our lifetime.

- We’ve wanted to do this for years, but have felt stuck: there are too many decisions, leading to analysis paralysis.

- I’m a systems thinker, so last year I set out to build a system. I used ProjectionLab to build a financial model, which gave me a yearly target to meet our goal of “give away all our money in our lifetime.”

- From there, I researched ethical systems for philanthropy, and cherry-picked the ideas that resonated most closely into my own framework for ethical giving.

- Financial nuts and bolts: we use a Donor-advised Fund (DAF), with a second fund for donations to places that aren’t formal non-profits. We also dabble just a little bit in mission-oriented investing.

For all the details, please read on.

Background: why develop a philanthropic framework?

A major personal accomplishment in 2022 – something I’m proud of – was creating a philanthropic framework. My wife and I intend to use this framework to guide our charitable giving for the rest of our lives, with the explicit goal of giving away almost all of our wealth in our lifetimes.

We’re at a level of financial security where we’re mostly safe from nearly all the financial threats we can expect to face – major medical bills, a housing market collapse, etc. Assuming even modest market returns, we won’t spend what we have in our lifetime. We don’t have (or plan to have) children, and we don’t anticipate needing to support our parents or siblings as they age.

We got here the way most wealthy Americans did: mostly privilege and luck, and a few smart choices. In our case: a large inheritance, me stumbling into a tech career in 1998, choosing state schools over private college, consistently choosing to live in places with a low cost of living, a couple of smart investments, and a very very good overall stock market in our lifetime.

Our options with this wealth seem to be:

- take up some sort of disastrously ruinous hobby like owning a yacht, racing sports cars, or investing in cryptocurrency,

- watch the line go up for the rest of our lives like we’re competing for a high score in the stupidest game ever, or,

- give it away.

Ethically, we’ve known (c) is the only compelling option for us, but we’ve stalled on it for several years because the specifics of how to do that felt complicated and hard. We’ve made ad hoc donations here and there, most small but a few big ones, but with no real focus. I’ve felt overwhelmed by analysis. I don’t want to just light money on fire; I want to give in a way that improves the world in some tangible way. But the multitude of decisions – where, when, and how to give – felt too complex, so I mostly avoided philanthropy altogether.

I’m writing this article for people in a similar spot. Many of my peers in the tech industry find themselves in a similar financial situation, and many don’t engage in philanthropy despite a general desire to do so. For folks in that camp, even if you don’t agree with my specific choices, I’m hoping this can serve as a sort of strawman and inspire you to develop your own philanthropic plan.

I’ve deliberately left some details out of this post, particularly anything about specific dollar amounts, financial institutions, tax details, and so forth. Talking about those things too specifically in public feels risky. But if you’re trying to get your own plan sorted, and talking through these things in detail would help, I would be more than happy to share more details privately. Get in touch: jacob @ this domain.

How do you give it “all” away, practically speaking?

We’re far from the only people to have thought about giving away our money. Perhaps most famous is the Giving Pledge, started by Warren Buffett, Melinda French Gates, and Bill Gates. But as someone looking to do the same, it’s all frustratingly vague. The Gates’ pledge letter is typical; all that it says about the mechanics of their philanthropy is that they “have committed the vast majority of [their] assets to the Bill & Melinda Gates Foundation”. So vague! They “committed” (whatever that means) the “vast majority” (whatever that means) to the charitable foundation … that they control. No details on amounts, timing, or selection of causes. This is typical: none of the other pledge letters is more specific; the organization doesn’t provide any resources for defining the what’s, when’s, and how’s; nor does any other resource I was able to find1.

So while plenty of people have pledged to “give it all away”, it seemed we were on our own to figure out the details. Those details are why I wanted to write this piece, so let’s get into it.

The key questions: “when” and “how much”?

We can imagine a spectrum of tactics around giving. At one extreme is “give away everything, right now”: donate all our money, right now. At the other end of the spectrum is “nothing until we’re dead”: don’t make any changes other than writing a will that gives all our money away after we die.

Neither of these extremes feels right. Giving all our money away right now means a level of sacrifice we just can’t stomach. Giving up our financial security might be noble, but it’s not something we’re willing to do. But the other extreme also seems wrong. Hoarding wealth does nothing to address the problems we see in our communities right now. More broadly, many problems we might help address through philanthropy compound over time. Climate change is the easiest example: pledging our money to help with climate change 40 years in the future is an empty gesture.

So, any practical approach needs to be somewhere between these extremes. We want to donate some money (how much?), sometime between now and the end of our lives (when?), and strike a balance between maintaining financial security and giving away enough (what’s “enough”?). For me, this is just about the perfect recipe for inaction. Tons of variables, unclear terms, and a sense that there’s an “optimal” approach (if I can only find it). Faced with problems like these, I frequently procrastinate – total analysis paralysis.

Building a system to guide philanthropy

I’m a systems thinker: I tackle problems like these by creating a framework, a set of heuristics, or some sort of system for narrowing complexity down to more simple choices.

So about this time last year, I set about to build a system to guide donations. Conceptually, I had simple goals:

- Set a yearly donation budget. I know that choosing where to donate is another analysis paralysis morass (much more on this in the next section), so I wanted a forcing function. “I must donate $X this year” helps cut through analysis paralysis: for whatever reason, it makes me feel a bit freer to choose “good enough” and not get stuck trying to find “perfect”.

- Set that amount high enough to gradually reduce our net worth over our lifetime. We have enough money; I’m not trying to set a high score on my investment account. The perfect outcome would be “die broke”, spending our last dollars on our funeral expenses.

In practice, figuring out this yearly amount is impossible: it requires predicting how long we’ll live, our future earnings, the movements of the markets over our lifetime, major medical expenses we or our families might face, and so on.

Modeling

But we can build a model, a simulation that takes (some of) these factors into account. We have to make broad assumptions about market returns, income, spending, life expectancy, etc. All models are wrong, but it’s not too hard to spit out a rough number. Importantly, because I’ll be giving money away over time, the risk is relatively low: I can always adjust what we give over time as reality happens.

Unfortunately, most financial modeling tools can’t handle the “reduce net worth over time” component. They all are built around the assumption that your goal is to increase net worth, endlessly, and trying to get them to tell you how to do the opposite is often impossible.

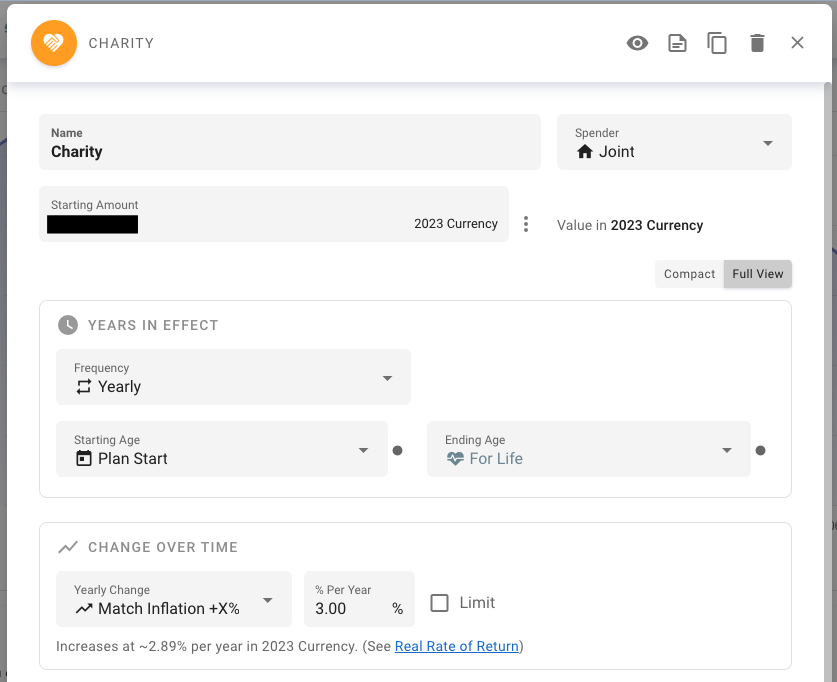

I originally built my own model using Jupyter Notebook but was eventually able to find out how to do this with Projection Lab, a much more portable approach. The trick is to model your charitable giving as a recurring annual expense:

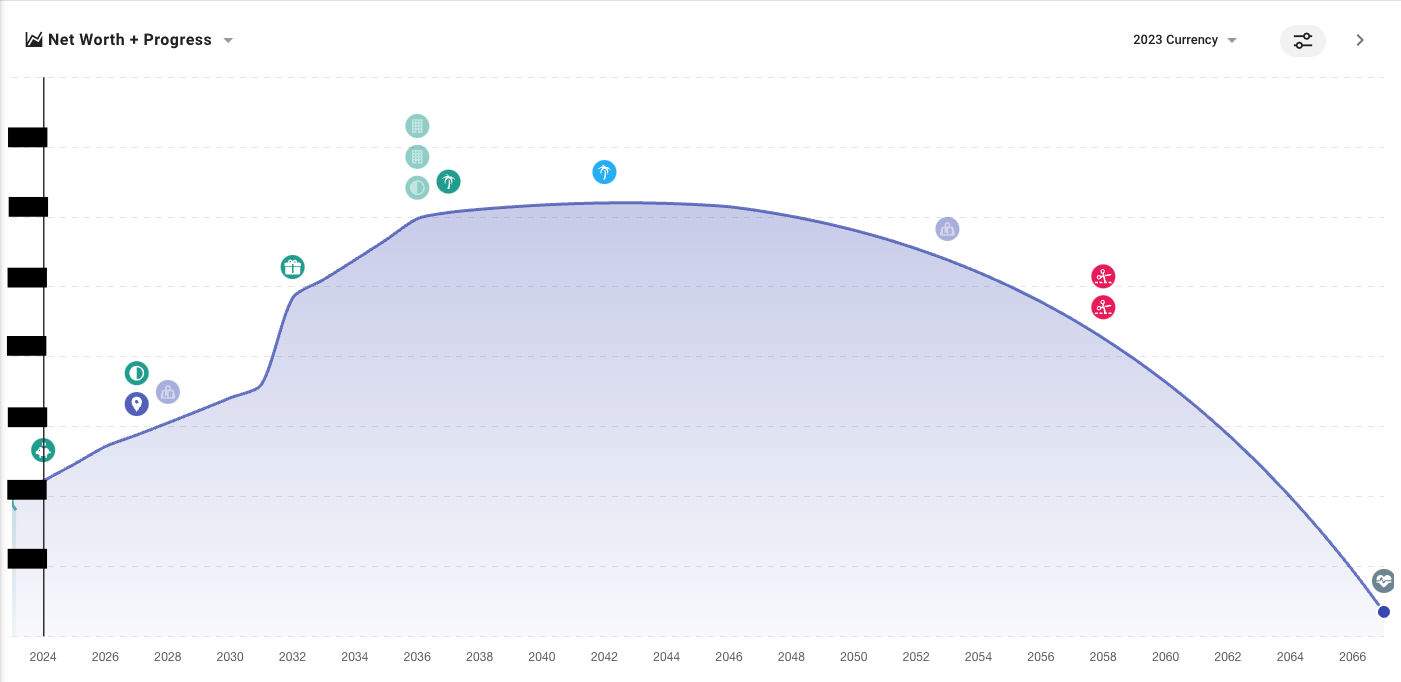

I came to the final numbers there – the starting amount, increasing by inflation + 3% – by playing around until I found a modeled outcome that matched my goal:

My financial projection, done with ProjectionLab. I’ve redacted the actual dollar amounts because I don’t feel comfortable publishing them publicly. However, if you’re considering setting up a similar program, and want to talk details, I’d be happy to share my numbers and go into much more detail privately.

With this, I now have a yearly charity budget. My wife and I split this up: we each get 25% to give away unilaterally, and we decide together how to use the other 50%.

Where to give?

On to the even more complex problem: where to donate?

Investigating existing frameworks for ethical philanthropy

I find making decisions about where to donate even more overwhelming. There are so many organizations deserving of support. There are also scams and frauds, charities that mostly exist to enrich their executives, and organizations that try but that are deeply dysfunctional. This is, for me, a perfect recipe for procrastination: faced with too many decisions, it’s easier to just do nothing.

Once again, the way I break out of analysis paralysis is to develop a framework. So along with the financial framework, I set out to find that ethical framework. I read a lot and spoke to a few other people in similar financial situations who were further along. I never found any existing framework that worked for me, but by cherry-picking parts that resonated with me from various forms of thinking about charity, I’ve come up with an ethical framework that I’m happy with and that guides my giving.

If you just want the final results skip ahead, but I think it’s interesting to describe the journey - the frameworks I considered and discarded in whole, but drew from in part.

In the sections that follow, I’m just going to focus on the pieces that resonated and that I drew on. I’m not going to get much into the parts that didn’t work for me. Some things about each turned me off, but this isn’t the place for that criticism. Suffice it to say that this isn’t a wholesale endorsement of any of these frameworks; it’s more like citing my sources of inspiration.

Maimonides’ Levels of Tzedakah

I have a complex relationship with being Jewish, but there are parts of Jewish philosophy that guide my ethics. So one of the first things that came to mind when thinking about charity was Maimonides’ guidance on Tzedakah (charity). In essence, Maimonides breaks charitable giving into a series of levels, with each being “better” (more ethical) than the lower ones. For example, giving willingly is better than giving unwillingly; giving without being asked is better than having to be asked; and so on.

Two main things about this framework resonate with me:

Anonymity. Maimonides’ second-highest level of charity is giving “without knowing to whom one gives, and without the recipient knowing from who he received”. Maimonides recognizes the power dynamics of giving money: a gift to someone you know can introduce an implicit feeling of obligation, intended or not, which can start to introduce a quid pro quo dynamic. This resonates: I very much believe charity shouldn’t be self-serving, and anonymity helps that.

That said, it’s not that simple: last year we helped friends with medical and educational expenses. Maimonides would, I think, look down on these situations: this is far from anonymous, and it’s sometimes been after being asked. This puts these in the lower third of Maimonides’ framework. But being able to do those kinds of things feels deeply important to our ethics. More on this in the discussion of mutual aid below.

This tension itself became valuable: it eventually led to me thinking of this ethical framework less as a set of hard and fast rules, and more as a sense of preferences and decision points, with some flexibility. More on this below when I talk about the resulting framework.

That the highest level of charity is the one that removes the need for charity at all. That is, seek to give in a way that creates lasting change, not quick fixes.

Effective Altruism

Anyone looking into frameworks for philanthropy is bound to run into Ethical Altruism.

These days, EA is getting well-deserved ridicule over its association with Sam Bankman-Fried. But a year ago it wasn’t quite so obviously scam-adjacent, and initially there was a lot about it that I found compelling. I still think some of the premises of EA are worth considering – to a point.

EA’s philosophy opens with a simple observation: one dollar is worth a different amount in different places. This is far from a novel observation; the fact that purchasing power varies is kinda built into the very concept of fiat currency. EA’s fundamental moral framework takes that idea and adds a moral dimension: if a dollar donated is worth different amounts in different places, we should seek to send donations where they’ll have the most impact.

I find this premise incredibly compelling. If CharityA can build a house for $10,000, but it costs CharityB $1,000 to build that same house, clearly I should give my money to CharityB.

I also find the intellectual rigor of measuring impact compelling. If we’re aiming to donate in a way that maximizes impact, that implies that:

- We have a theory of change about why an intervention would cause some positive result

- We measure those results to validate our theory

- We adjust our approach if the results aren’t what we expect

Again, this is all very compelling. The amount of money that I have to donate is not limitless. I don’t want to just light it on fire; I want to use it to make as much good as I can.

Beyond this basic premise, however, Effective Altruism gets increasingly gross. Once again my goal in this piece isn’t to critique philanthropic frameworks, and criticism of EA is well-trodden ground. I find the way EA defines impact to be distasteful2; the movement’s claims about intellectual rigor are hypocritical3; they have this weird-ass obsession with “evil AI”4; and so on.

So while I found some of the core ideas behind EA compelling, I can’t at all get behind the movement as a whole.

Mutual Aid

Finally, I drew some inspiration from the concept of Mutual Aid. I know the least about Mutual Aid – honestly, did very little research beyond some very basic initial reading – so take what I say about Mutual Aid with a huge grain of salt. But my basic understanding is that Mutual Aid isn’t a framework for charity – in fact, it’s an alternative to the very idea of charity itself. It’s a practice based on community action and solidarity, where communities pool resources to address the needs of everyone in the community.

Two ideas from Mutual Aid stuck with me:

- The concept of giving in community: it’s important to me to support the communities I’m part of. It’s hard to articulate why this is so important to me… I guess it’s a variation of “think globally, act locally”. It doesn’t feel right to chase some hypothetical “best” use of philanthropy when there’s a need right here in front of me. It’s important to me to care for the members of the communities I’m part of.

- Trusting people when they tell you what their need: charity can often start to seem incredibly paternalistic – “well, I know you say you need X but I know better, I’m going to give you Y”. Mutual Aid begins with the assumption that if someone tells you their needs, you believe them. I can’t see why this is controversial!

My ethical framework for philanthropy

While none of these existing systems fit well, they all had pieces that resonated. From those pieces, I put together the framework that works for me. I’ve phrased these as “preferences”: they’re not hard and fast rules, but instead a set of more general goals I can use when evaluating a potential gift. They’re also not entirely consistent – some of these principles are in tension with others – but I find these tensions good, as they express a level of complexity that can’t be reduced.

- Prefer anonymous to named (Maimonides). Giving anonymously is one of the core principles that feels important to me. Money makes things weird: it’s very hard to give money to someone you know without them feeling like some strings are attached.

- Prefer organizations to individuals (Maimonides). Giving through organizations is a great way to achieve anonymity: while the organization might know who I am, the people they support don’t. Organizations also can leverage economies of scale: e.g. RIP Medical Debt can, by negotiating in bulk, get huge discounts on medical debt, which is more effective than if I try to pay an individual’s debt directly.

- Prefer organizations that make more impact per dollar (Effective Altruism). I’d like my money to be as effective as possible, so I’ll look for organizations with low overhead and high effectiveness. If there are multiple organizations in the same space, I’ll generally prefer the one that demonstrates more impact per dollar.

- Prefer to give in community (Mutual Aid) — I want to support the community around me. I don’t use the word “local,” since we’ve moved around a lot, so my communities include places where I no longer live but with which I still feel a connection. It also includes the global Python and Django communities, groups that are close to me emotionally despite being physically far-flung. “The community around me” also means supporting people in my life who need help. Yes, this conflicts with my first point; that core tension between working in community and trying to remove the ego can’t be resolved without giving up something important.

- Prefer more immediate impact to “Black Swan” donations like politics and AI (anti-Effective Altruism). There’s a class of donations that are trying to influence low-probability but high-impact outcomes (sometimes called “Black Swans” after Nassim Taleb’s book). Reasoning about low-probability events is very tricky (I do it for a living), and leads to all sorts of weird thinking, as with EA’s fixation on AGI. I’m not opposed to thinking long-term, but when it comes to charitable giving I tend to prefer impact I can see in my lifetime.

- Prefer organizations run by the people they’re aiming to help (e.g. trans health organizations run by trans people; debt relief organizations run by people in the communities they help; etc.) (Mutual Aid). The history of philanthropy is littered with White Savior nonsense – organizations that are (at best) well-meaning, but run by people with no clue about the conditions on the ground. Being close to an issue isn’t a guarantee of accuracy, but telling people what they “really” need is the height of hubris.

These are the factors that I consider when deciding where to donate. Again, these are sometimes in tension, so it’s not uncommon to give in a way that’s not 100% aligned with each of these preferences. But I’ve found in practice that these basic guidelines are sufficient to break out of decision paralysis and make a clear decision.

Nuts & bolts: the financial mechanics

Finally, some details on the financial mechanics.

Giving through a Donor-advised Fund (DAF)

We decided that it made the most sense to do the bulk of our donations out of a Donor-advised Fund. In the US, a DAF is a special kind of non-profit that acts as a sort of intermediary between donors and the downstream charities they want to support. When we put money into our DAF, that’s what counts as the donation – we get the charitable write-off that year as a tax deduction, and the money now belongs to the DAF. We retain advisory control over the money we donated, and can “recommend”5 that the DAF later donate money on our behalf to another charity.

When our financial advisor first suggested a DAF, I wasn’t thrilled. I’m not a huge fan of DAFs from a policy standpoint. They form a sort of tax loophole that very rich people like Zuckerberg and Bezos routinely take advantage of. E.g., I’ve seen stories of billionaires “donating” their house to their DAF, then continuing to live in that house, tax-free. Or paying huge “management fees” to family members.

However, using a DAF does provide us several super important benefits:

Most importantly: donations out of the DAF can be anonymous. We can attach our names to them if we want, but if we don’t, all the recipients see is that they’ve received a donation from “The X Charitable Foundation”. Anonymity is one of the main tenets of our ethical framework, and I’m not aware of a better mechanism.

The DAF handles the sometimes-complex details around donating stock. Most of our assets aren’t in cash, so making large donations means either figuring out how to donate stock directly (doable but often complicated), or selling the stock, paying gains taxes, and then donating the proceeds. We’ve done this ourselves, and it’s a pain. It’s a logistical barrier that’s served to give us an excuse to procrastinate. With the DAF, we tell them where and how much to donate, and they figure out the logistics. Critically, because the DAF itself is a nonprofit, they won’t pay taxes if they sell stock to make cash donations.

Speaking of taxes: the DAF lets us maximize our tax deduction. The donation into the DAF is that part that counts as the charitable donation for our taxes. This means that when we make our annual donation to our DAF, we claim that donation on our taxes that year, regardless of when we eventually donate money out of the DAF to its eventual recipient. And, as mentioned above, when we donate stock to the DAF, we avoid paying taxes on any capital gains on that stock.

As with DAFs in general, my feelings about this tax avoidance strategy are mixed. The fact that rich people can generally dodge taxes using vehicles like this is gross and bad for society. But that being said… the way our current government uses our taxes is also gross and bad for society. An outrageous percentage of taxes funds the military, police, and carceral state. Another big slice funds our draconian border policy and federal prisons. In a world where our government was more aligned with my ethics, I would feel worse about avoiding taxes. But in this world, I guess I’m OK with some tax shenanigans.

If you’re considering a DAF, there are a couple of downsides to be aware of:

DAFs charge a management fee, sometimes as much as 1% of your balance. Our DAF is through the same bank our financial advisor works for, so in our case, the fee is waived (more accurately: it’s rolled into the fees that we already pay our advisor). I believe that Vanguard Charitable has the lowest fees out there but I didn’t do a ton of research. Shop around.

Donations out of a DAF must be to another 501(c)(3) nonprofit. This means you can’t use money in your DAF to donate to a GoFundMe, pay a friend’s tuition, cover someone’s hospital bill, etc. More on this below.

Recurring donations may be a bit harder to set up. Many non-profits prefer recurring donations – they’re a more predictable income stream than one-offs – so I like to use them for smaller donations. Unfortunately, DAFs don’t always make that easy. Our DAF, for example, used to require a phone call to set up a recurring donation (they’ve only recently added recurring donations as an option to the web app). And even that’s more of a pain than being able to directly make a credit card transaction with an organization you want to support. We let our choice of DAFs be dictated by existing banking relationships, but if we hadn’t I’d have done some shopping around to try to find the one with the best donation flows, specifically including recurring donations.

Mechanics: every year, in January, we make a single large donation to our DAF, using the financial projection developed above. This forms our philanthropic “budget” for the year – our goal is to spend down the DAF to close to zero every year. That’s just a personal practice, however; there’s no penalty to leaving money in the DAF and donating it later.

Using a second fund for non-501(c)(3) donations

It’s also important to us to give money to people or groups that aren’t recognized non-profits: helping with medical costs, education expenses, and so forth. These sorts of Mutual Aid-style donations can’t be done through a DAF but they’re important to us.

So, the second part of our financial mechanics was creating a dedicated checking account for these kinds of gifts. This is just a boring old checking account with a debit card. Like our DAF, we move money into this account yearly, and use its balance as a budget for non-501(c)(3) gifts. Using a separate account helps with structure: having a separate budget that we allocate ahead of time creates that “forcing function” that we’ve found so helpful. It also helps with budgeting — we don’t have donations mixed in with groceries or whatever, so it eases bookkeeping.

Mission Oriented Investing

Finally, we’re doing just a little bit of mission-driven investment. For us this means two things:

- We’ve made two angel investments in startups that are aligned with our ethical goals. One of these is Tall Poppy; the other I don’t want to talk about yet. We do believe these investments are going to pay returns, but we’re not at all interested in being angel investors more broadly – that’s too risky a field for our fairly-conservative investment approach. Instead, we see these investments as alternate ways to further some of our philanthropic goals, and that makes the risk much more palatable.

- We’re slowly aligning our investment portfolio with our charitable goals – for example, divesting from fossil fuel companies and moving that money into green tech. This is difficult to do without a massive tax bill so that’ll take several years, but it feels worth doing.

How’s it going - and what’s next?

We set this up about a year ago, so how’s it going?

Well, we’ve solved what I see as the biggest problem: not doing anything. We spent most of our 2022 budget, and have given more and more frequently out of our secondary non-NPO fund. I think we’ve more or less solved the biggest original problem of analysis paralysis.

However, I wouldn’t say it’s all perfect yet. I’m still finding it hard to feel like we’re giving in any sort of optimal way. For example, in 2022 we made a donation to Trans Lifelife, but I’m not sure they’re the “best” Trans Rights organization to be supporting – and they’re certainly not the only organization I should be supporting6. Without this system, it’s highly we’d have done nothing, so I’m happy to have moved from “nothing” to “something”. But I’m hoping the next iteration of this system will improve how we identify and evaluate organizations to support. (If I do make some progress there, I’ll try to write about it!)

We also need to work on our system for allocating that “shared” part of the budget. Right now it’s pretty ad hoc, and driven by our arbitrary December “deadline”. We probably need to set up some sort of regular check-in — or, I guess, decide that making our large donations once per year is something we’re happy with.

Get in touch if this helped, or if you want to get in the weeds

Phew, that was a lot! I hope you learned something, and if this inspired you to make your own plans to give away your money in your lifetime, I would love to hear about it. Please also feel free to get in touch if you’d like to get even further in the weeds about my own plans: I’m happy to get even more detailed in private.

Thanks to my writing partner, Sumana Harihareswara for talking through this with me, extensively, as I wrote it, and helping to edit the final piece. Thanks also to Liz Fong-Jones, who met with me last year as I was starting to put this together and got me started by sharing information about her philanthropic approach.

Side note: if you’re looking for a philanthropist role model, someone far better than Gates or Buffet is MacKenzie Scott. She isn’t bragging about a lofty pledge, isn’t giving TED Talks about “saving the world”, and isn’t just leaving money to charity in her will. Instead, she’s quietly giving away vast sums of money – $14 billion between 2020 and 2022! ↩︎

EA measures impact using something called a Quality-adjusted life year (QALY). The term comes from the health insurance industry – that’s maybe your first clue that the term isn’t something you want to base an ethical foundation upon. The very idea of comparing lives to each other in this utilitarian way feels nasty. And it gets worse: QALYs give EA a very retrograde understanding of disability. E.g., an insurance adjuster would say that a Deaf person has a lower quality of life than a person with full hearing, a statement that most Deaf people I know would find inaccurate and rage-inducing. And particularly nasty is the idea that the Effective Altruist is the one deciding “how many QALYs” an intervention saves. This sets up a dynamic of a group of rich, mostly white, mostly American, mostly men (see below) sitting in judgment of the “value” of people’s lives. And this is the foundation of how EA measures “effectiveness”, ugh. ↩︎

The signature original cause of the EA movement, deworming, has been roundly debunked – yet the movement stubbornly refuses to, as they would say, “adjust their priors” and admit that their signature cause was based on flawed science. ↩︎

The EA community has become fixated on hostile Artificial General Intelligence. They define the impact of this event as essentially infinite (“destroy or enslave all humans”). Since

Risk = Impact × Likelihood, if Impact is infinite, then Likelihood is irrelevant and Risk is always infinite as well (anything times infinity is infinity). If you frame it this way, Hostile AGI becomes the most dangerous possibility to humanity – worse than climate change, worse than nuclear war, worse than the worst infectious disease – and thus the most deserving cause to donate to. See, EA is fucking weird. ↩︎I put this in quotes because while technically the DAF could refuse to honor or “recommendation”, in practice a DAF can’t really refuse these “recommendations” (as long as it’s a recognized 501(c)(3) charity) and still be able to attract money. ↩︎

I would be thrilled to get suggestions about who to support in this space – particularly if you work in the space or have received support from one of the organizations working here. ↩︎